operating cash flow ratio vs current ratio

It indicates the amount of cash at the balance sheet. Operating cash flow ratio vs.

Cash Flow Ratios Calculator Double Entry Bookkeeping

Carbonmeta Current Ratio vs.

. The formula for calculating this important ratio is as follows. The cash flow to debt ratio is expressed as a percentage but can also be. If this ratio is less than 11 a.

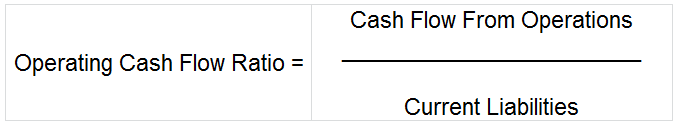

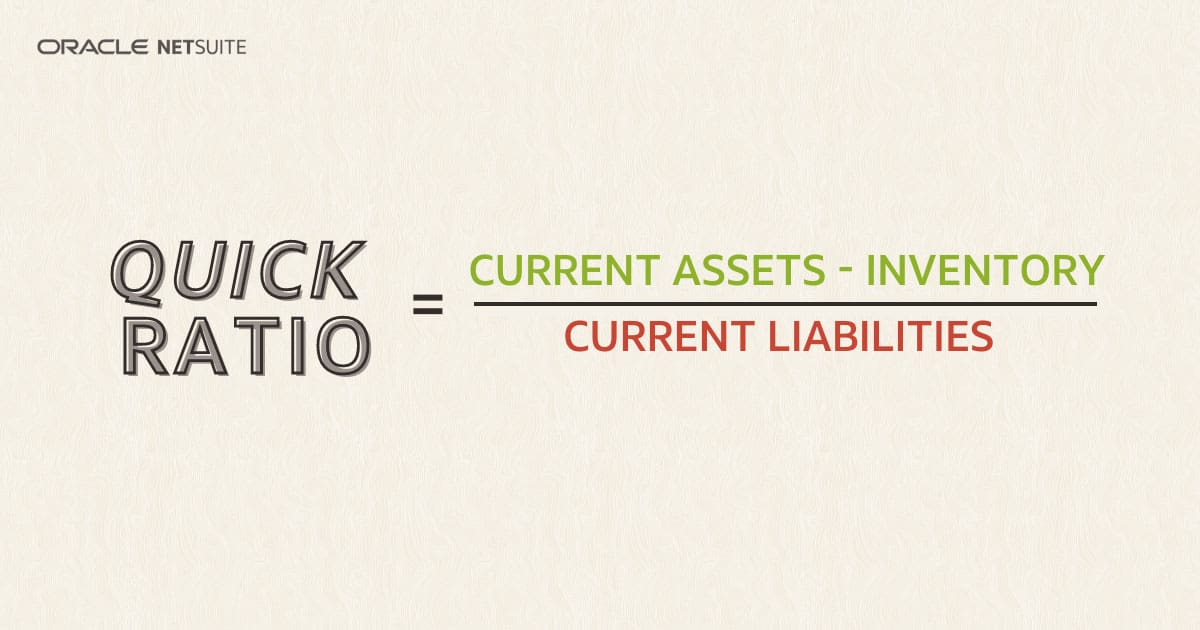

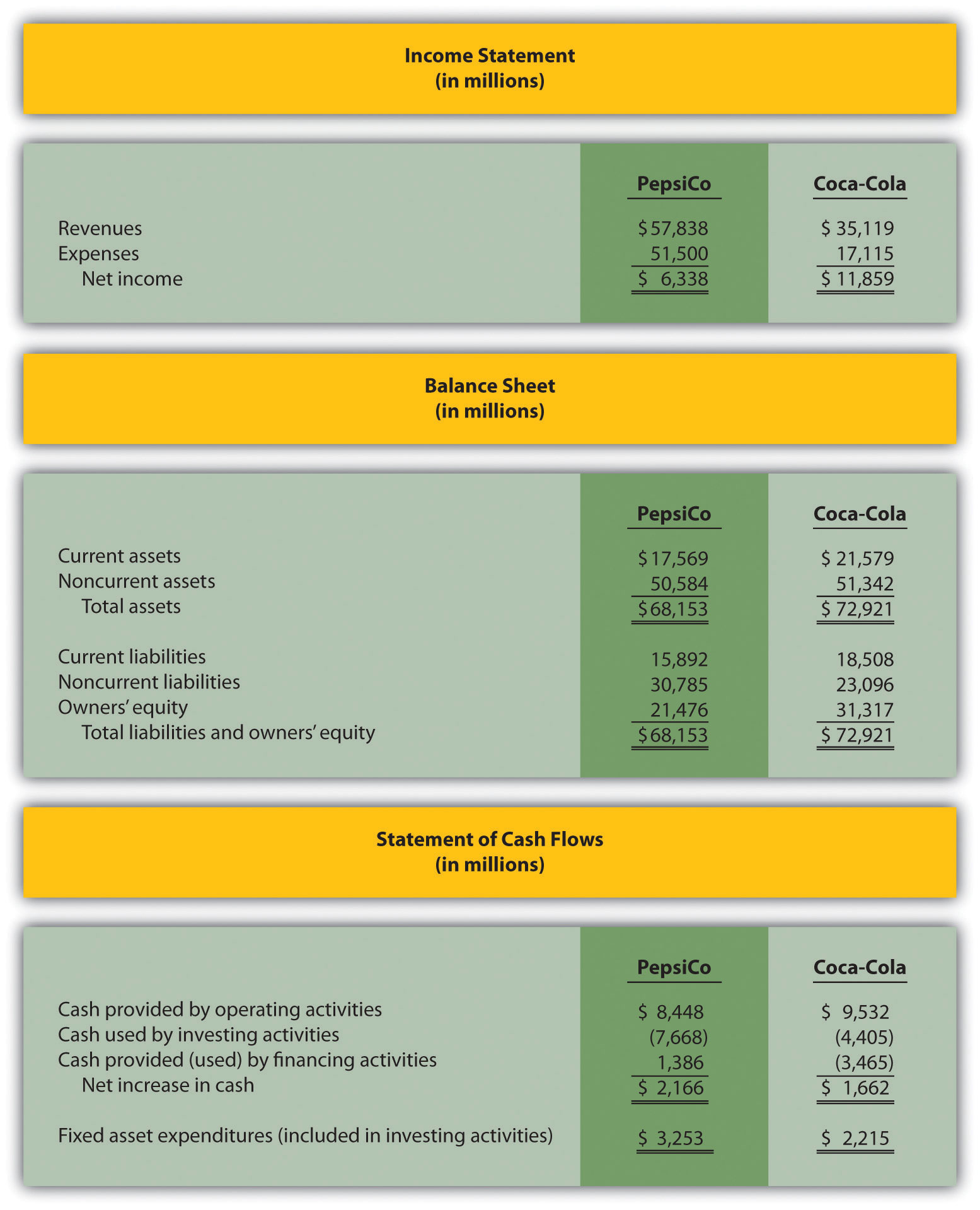

The only difference is that the operating cash flow ratio takes into account the cash flow from operations whereas the current ratio considers the current assets. The current ratio of a business measures its ability to pay its current liabilities using its current assets such as cash. Starbucks Corp is currently regarded as top stock in cash flow from operations category among related companies.

Calculated as the share price divided by the operating cash flow per share. The operating cash flow ratio assumes that current commitments will be paid with cash flow from activities ie current liabilities. The operating expenses current year worksheet is for you to enter the actual operating expenses for the current year.

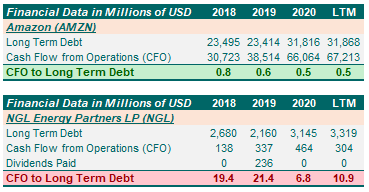

Both the operating cash flow ratio and the current ratio measure a companys abilitThe operating cash flow ratio assumes cash flow from operations will be used to pay those current obligations ie current liabilities. The cash flow-to-debt ratio is the ratio of a companys cash flow from operations to its total debt. Ad Download our toolkit to learn how to forecast cash flow statements even in uncertain times.

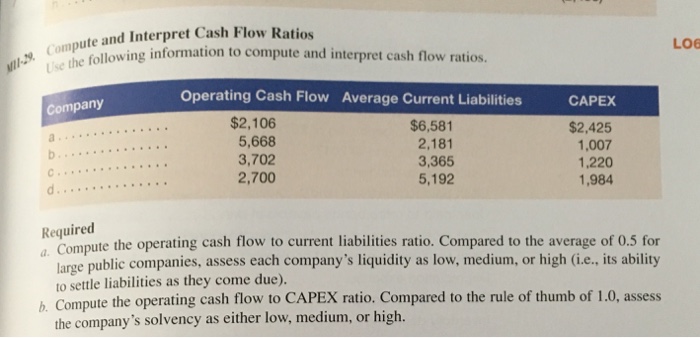

This ratio is qualitatively better than the priceearnings ratio since it. The operating cash flow ratio is a liquidity ratio that measures how well a company can pay off its current liabilities with cash generated from its core business. Cash Flow from Operations.

Operating costs and current equity. It does not include dividends in the formula. The operating cash flow ratio and current ratio can both be used to determine the ability of an organization to pay its current obligations.

Company can use current ration indicates a firms ability to. The following is an example of a current ratio calculation. The ratio is calculated by dividing the business cash flow from operations by its total debt.

It is currently regarded as top stock in current ratio category among. Schneider Electric Cash Flow from Operations vs. Operating Cash Flow reveals the quality of a companys reported earnings and is calculated by deducting companys income.

The current ratio meanwhile assumes current assets will be used. Stock CRESCENT POINT ENERGY CORP. The current ratio equals current assets divided by current liabilities.

Operating Cash Flow shows the difference between reported income and actual cash flows of the company. CRESCENT POINT Cash Flow from Operations vs. Meanwhile the current ratio anticipates that.

However this ratio is used to. Price to Cash Flow Ratio. Forecast your future cash position and regain your control on your business finances.

Current assets Current liabilities Current ratio. If a firm does not have enough cash or cash equivalents to cover its current. While calculating the operating cash flow ratio cash flow from operations are considered to pay off current liabilities while for calculating the current ratio the company.

This ratio is a type of coverage ratio and can be. For Gsk Plc profitability analysis we use financial ratios and fundamental drivers that measure the ability of Gsk Plc to generate income relative to revenue assets operating costs and. 10 Cash flow statement current year.

Cash Flow-to-Debt Ratio. The operating cash flow ratio is different from the current liability coverage ratio in only one way.

Current Ratio Definition Formula Example

What Is Operating Cash Flow Ratio Accounting Capital

Price To Cash Flow Formula Example Calculate P Cf Ratio

Quick Ratio How To Calculate Examples Netsuite

Cash Flow Coverage Ratios Aimcfo

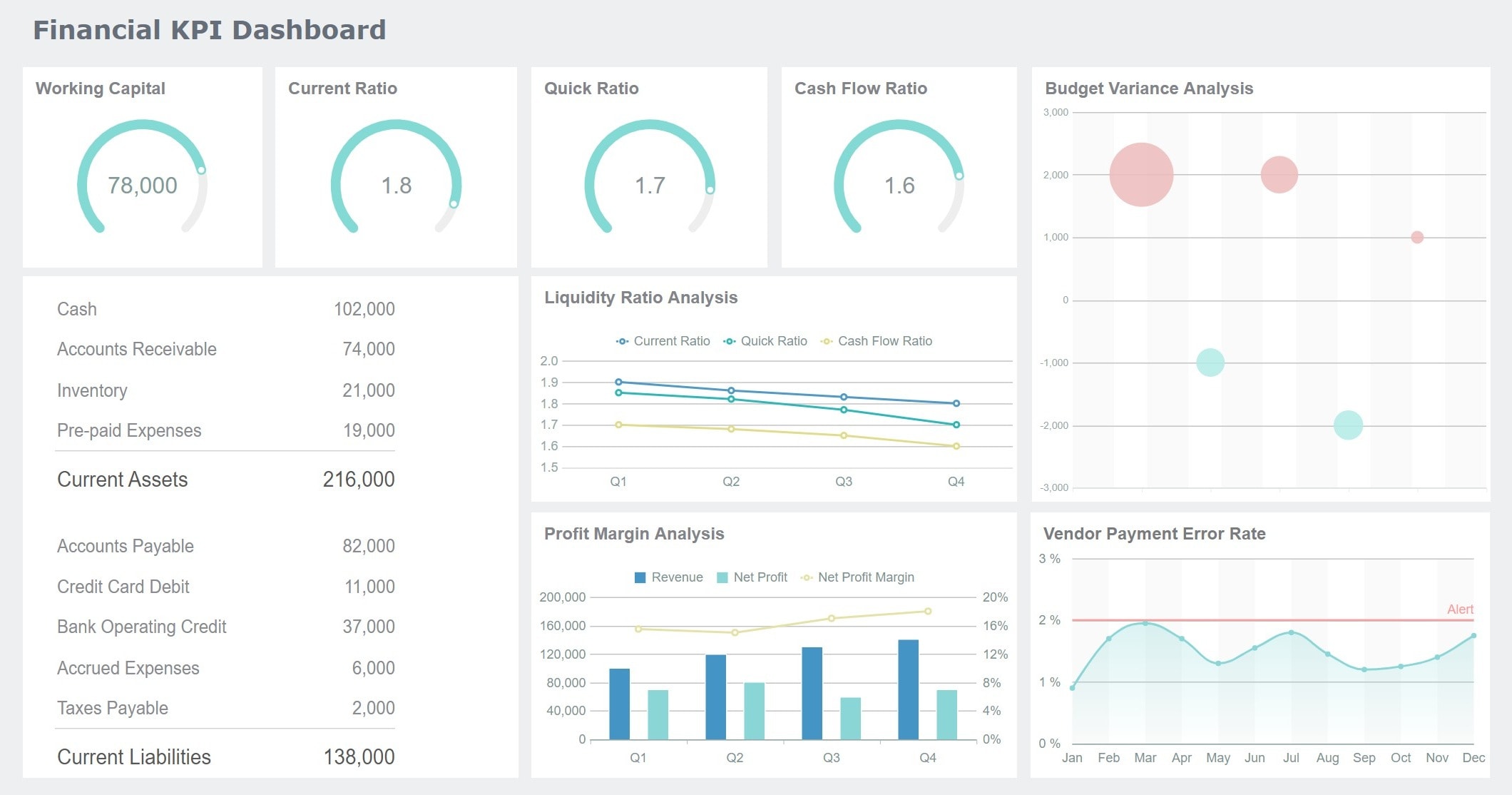

Financial Dashboard Templates Examples Finereport

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

The Value At Risk Operating Cash Flow To Current Liabilities The Self Sufficiency Ratio

Comparison Of Ratios Download Table

Analyzing Cash Flow Information

How To Calculate Your Debt To Equity Ratio Orba Cloud Cfo

8 Cash Flow Ratios Every Investor Must Know

Solved Use The Ratios Calculated Above For Company A And Company B To Cliffsnotes

Operating Cash Flow Ratio Definition And Meaning Capital Com

Solved Compute And Interpret Cash Flow Ratios The Following Chegg Com